Wisconsin homeowners coverage can protect you from the various hazards of home ownership, regardless of whether you're building or remodeling a home. The state is prone to natural disasters and floods, so it's important to have coverage in place that protects your home from loss.

The Best Home Insurance Wisconsin: In Wisconsin, several companies offer excellent coverage for a low price. Here are some top options you should consider when selecting a home insurer.

Lemonade: With their AI-powered smart insurance platform, this company makes it simple for customers to purchase, manage and submit claims. The company also provides a user-friendly app and comprehensive policy that allow customers to compare rates across multiple providers.

Erie offers a wide range of insurance options, great rates, and excellent service. Standard policies offer a wide range of coverage options for home insurance, including storm damage coverage and guaranteed replacement costs. This benefit protects from losses if you have insured items that are worth more than your current home value following a covered incident.

Badger Mutual offers low rates, and has high customer satisfaction ratings. This company is an excellent choice for Wisconsin residents. The company also offers discounts and additional insurance riders for security and safe homes.

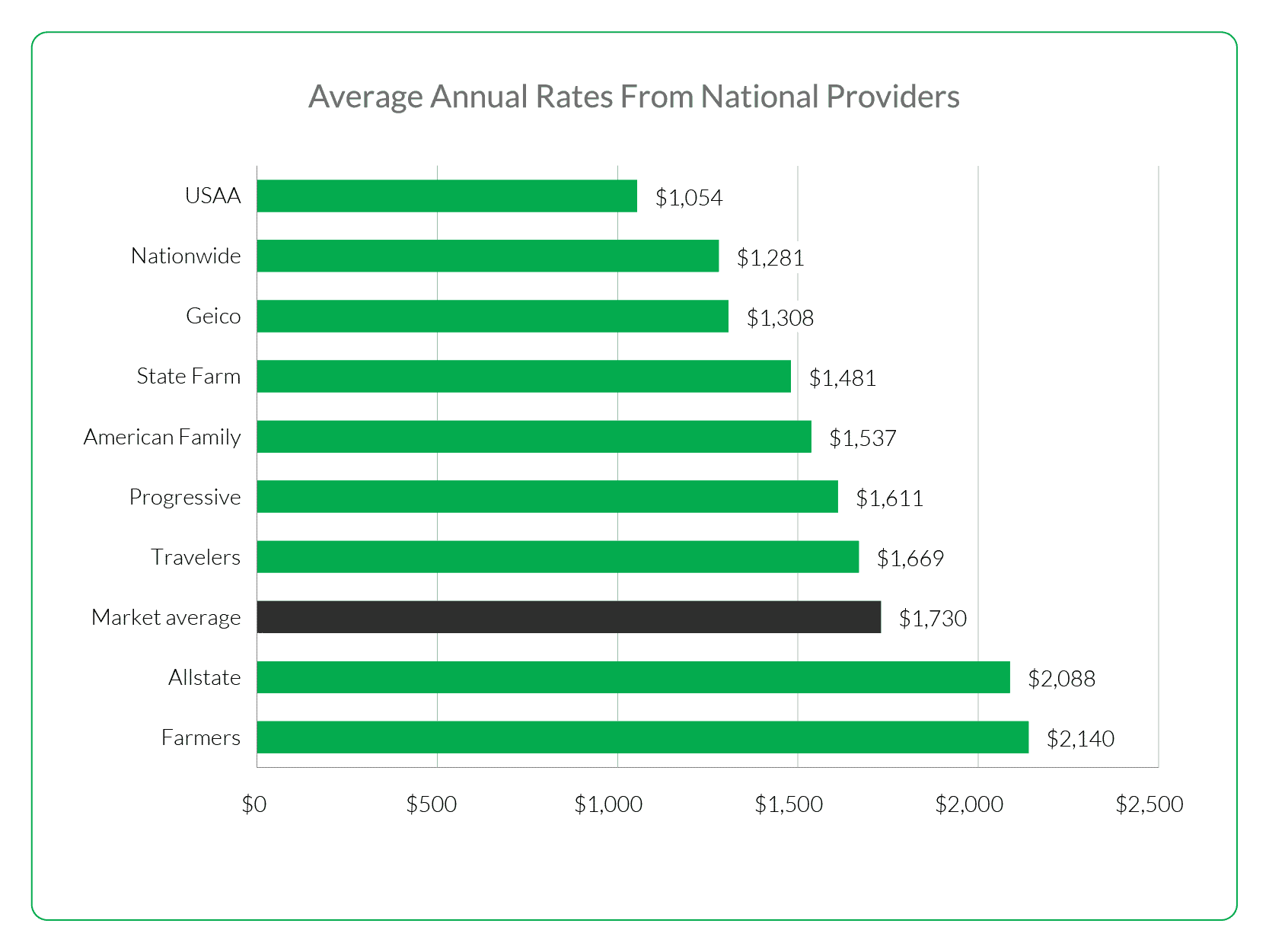

Farmers: A quality policy is available at a great price. Standard policies cost less than half of what the average state policy costs for a newly constructed home. It also offers the best prices for older homeowners.

West Bend: This is a great choice for homeowners who have previous claims on their policies. It is one of Wisconsin's cheapest home insurance providers and has the lowest premiums for homeowners that have had previous claims.

Affinity Insurance: This is the best choice for anyone looking to get affordable homeowners insurance in Wisconsin. Its policy holders only pay $347 per year. This is almost half the average cost of homeowners insurance in Wisconsin for a house with no previous claims history.

Also, their quotes are among the lowest for homes without a history of claims. The company has a great track record for customer satisfaction. They offer a variety of benefits including a 24/7 Emergency Line and a Money-Back Guarantee.

AARP Insurance: This company offers quality homeowners insurance that is easy to manage in Wisconsin. Its policies are designed with seniors in mind and offer a variety of ways to save, such as bundling home and auto insurance.

This company is a good choice for those who want to make green upgrades to their homes. The standard policy covers energy-efficient items and environmentally-friendly products, such as solar panels and wood-burning stoves.

Wisconsin has a lower average cost of home insurance than the nation, at $1,084 a year. To get a quote and learn more about your specific home's coverage needs, you can use our search tool below to view averages from top home insurance carriers in your area.