If you're a senior citizen, you need homeowners insurance that meets your unique needs. This coverage is essential for your home and possessions, as well as liability protection if someone gets hurt on your property. This will give you peace ofmind knowing that your home and possessions are covered, as well as liability protection if anyone gets hurt on the property.

Senior Citizens and Home Insurance

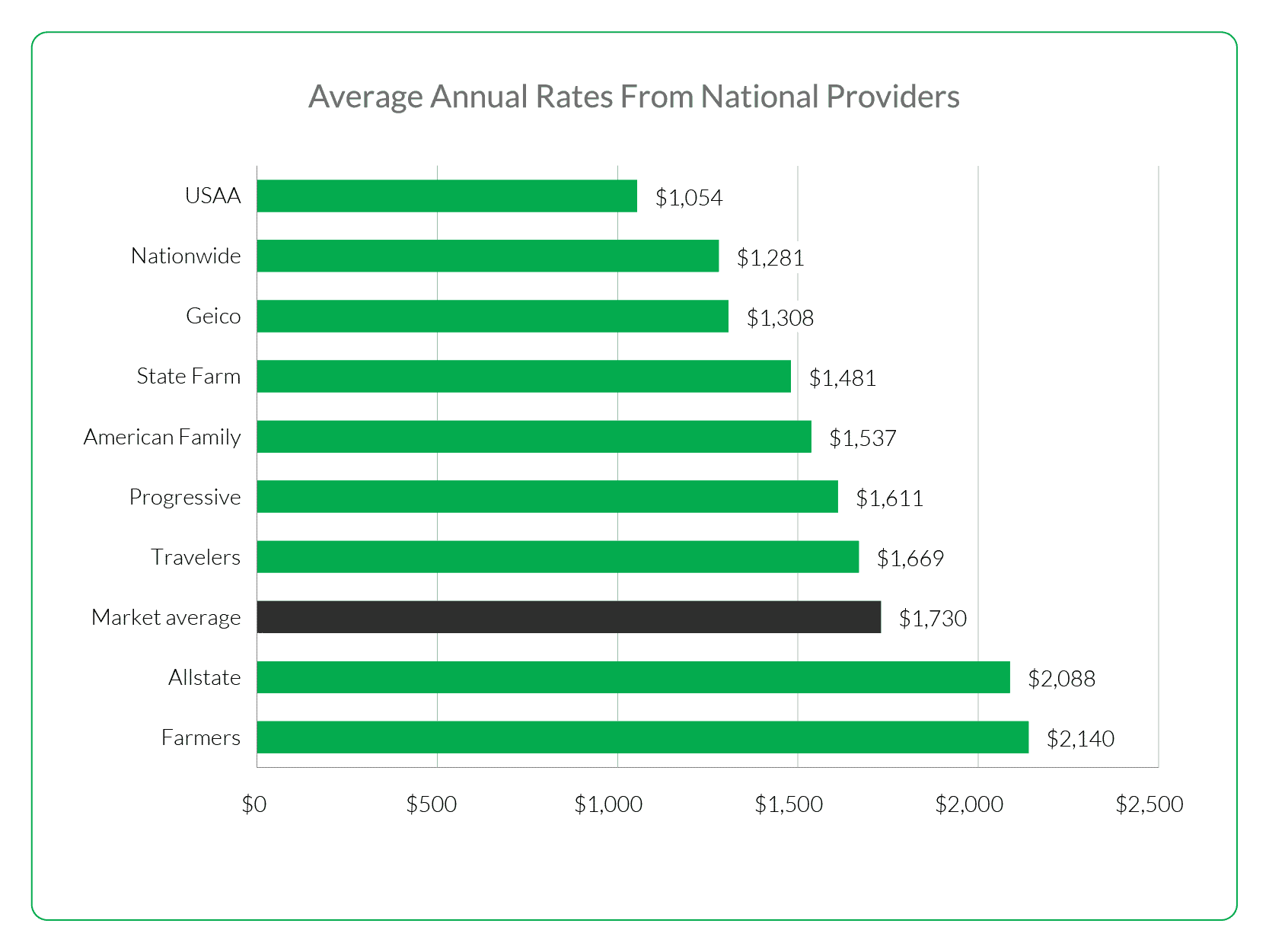

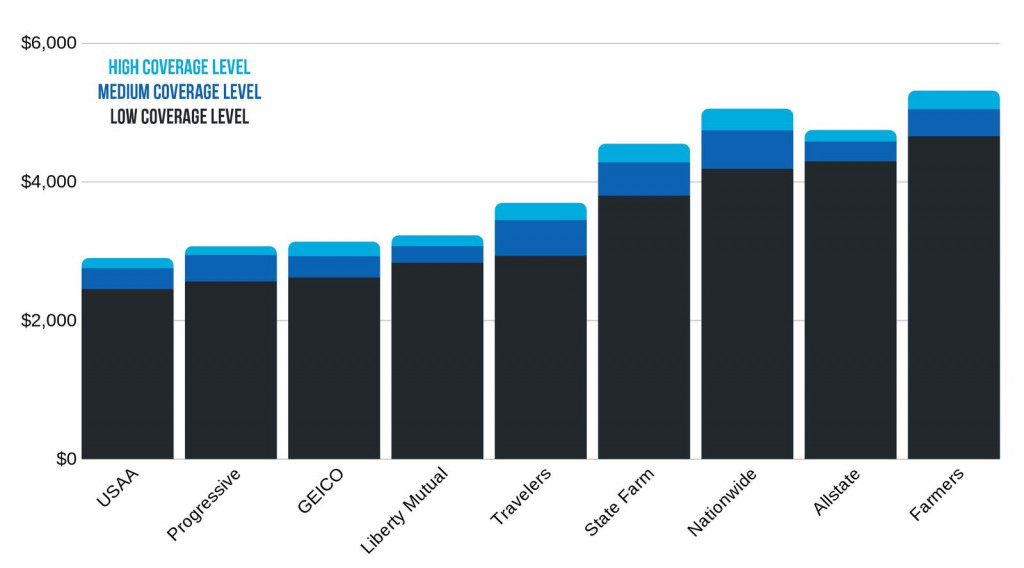

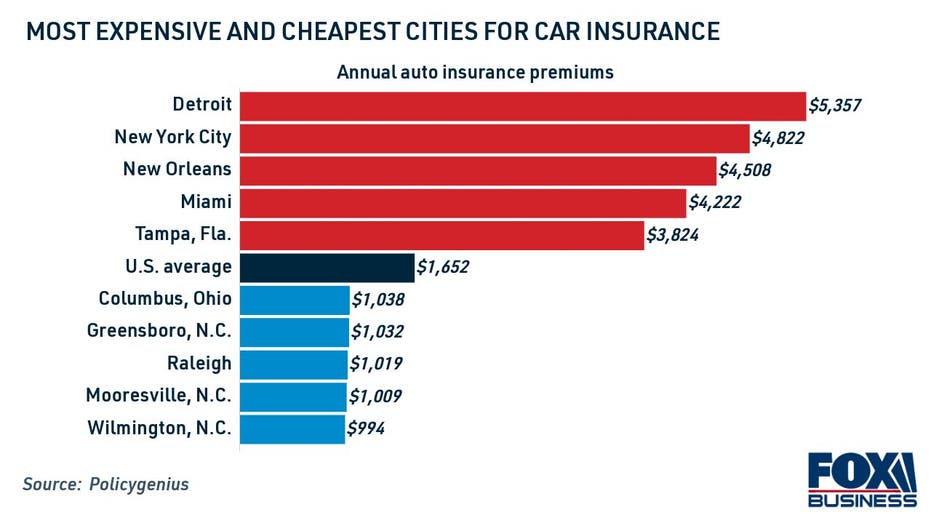

It is important to shop around for insurance policies to ensure that you get the best deal. The cost depends on a number of factors, such as your age and home's condition, location and claims history.

Improving your credit score is one of the best ways to lower your insurance rates. This can help you qualify for discounts from some providers.

Seniors can also save money on their home insurance by taking advantage of the discounts available. These discounts range from 10 to 25%.

Most home insurers will offer discounts to retirees, as they are less likely make claims for insurance and spend more quality time at their residences than most other customers. They're more aware of potential hazards like gas leaks, electrical fires and ruptured pipes - and therefore may be able to detect them before they become too costly to repair.

Sean Meehan's second vice-president of Travelers Insurance, Hartford, Connecticut, is a specialist in property strategy, design and marketing.

Discounts are available for seniors, but they vary between companies. Talk to your agent about this or visit the websites of individual providers to find out whether you qualify.

Membership in affinity groups and associations, the use of green materials and security systems, and homes that are storm-resistant can all be used to reduce your homeowner's policy. Other benefits may be available depending on your insurance provider. These include a guaranteed-renewal program, On Your Side (r) Review, and green materials.

You should also consider adding higher limits for guest medical payments and personal liability if you have visitors regularly. If you don't already have them, these limits can be added. They may be necessary to cover visitor injuries and damages on your property.

Seniors' needs for homeowners insurance will be determined by the size, price and type of property they own. If you own high-value items like jewelry, furs, or art, then you may want to consider an HO-3 policy or a HO-5 insurance policy. This will increase your coverage limit.