To protect your property, you need older mobile homes insurance. These policies include coverage for a variety of perils including windstorms, lightning, and falling objects. These policies also offer coverage for personal items such as furniture and electronics.

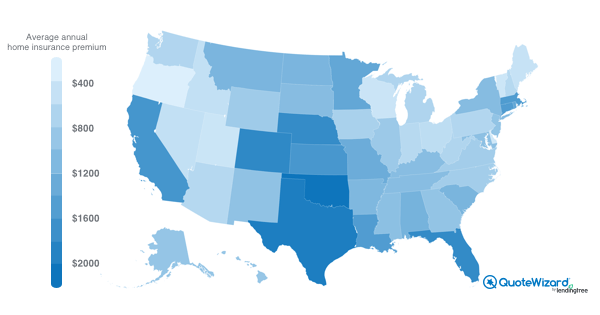

The cost of mobile house insurance can be affected by several factors. These include where you live, the value of your personal property and your claims history.

There are many companies that specialize in mobile insurance. You may save money if you bundle your policy with another kind of home coverage. You may also be eligible for discounts if you install a home security system or sign up for an easy-pay plan.

Older mobile homes tend to be more expensive to insure than newer ones because they are not built up to the latest building and safety standards. They are also more likely to suffer from faulty wiring and leaking pipes, which can lead to structural damage.

You can get affordable insurance for your older mobile home from some of the major companies. State Farm, Allstate as well as specialized companies who specialize in insurance for mobile homes make up this list.

Some companies also offer special discounts for older homeowners and for people with a history of good credit. These discounts can reduce your insurance by up to 15 percent.

Comparing quotes and shopping around can help you save money on mobile home insurance. The NAIC states the premiums can be affected by various factors such as the age of your home, its condition, coverage limits and claims history.

What is the older mobile home insurance policy?

Insurance for mobile home covers a range perils. From fire and windstorms to explosions and burglary. You are also covered for liability if you cause injury to someone on your property.

What is the average cost of older mobile home insurance?

It is possible to save on the price of insurance for an older mobile home by comparing rates and shopping around. The cost of mobile home insurance for older homes is also affected by where you reside, the value of the personal items that you own and your previous claims.

What are the best insurance companies for mobile homes?

The best mobile home insurance companies can offer you a variety of options, from low premiums to high-quality service. These companies can assist you with finding the most suitable policy, whether it's for a single-unit mobile home or a two-wide one.

You will be covered for any additional costs, such as repairs or relocations. There are also special policies for catastrophes such as floods or earthquakes.

What are older mobile homes insurance benefits?

For retirees looking to downsize their primary home, older mobile homes are a great choice. They can be a great investment. The houses are more mobile than the traditional house and they usually have more features.