In Florida, homeowners have the choice of many insurance companies. Some offer more coverage than other. Some are more costly than others. Before you make a final decision, compare several quotes from different companies. Consider the discounts that are available for wind mitigation. Those features can protect your home and reduce your insurance premiums. They may also be free. You should also check with your insurance company to see if there are any discounts.

State Farm

State Farm announces plans to cancel almost 700,000 homeowner insurance policies in Florida after a difficult year. The company will also cancel almost 80,000 condominium policies and 62,000 renter policies. It will also cancel 58,000 boat insurance policies. This rate hike was prompted by the Florida hurricane season of 2004, when the company's Florida affiliate had to borrow $750million from State Farm Mutual of Illinois. This debt still remains unpaid. The Florida affiliate reported that their surplus had declined by $201 millions during the first three months of 2008.

State Farm homeowners insurance offers coverage for injuries due to flooding, fire, or other natural disasters. There is also an option to increase your home's worth by 20%.

Allstate

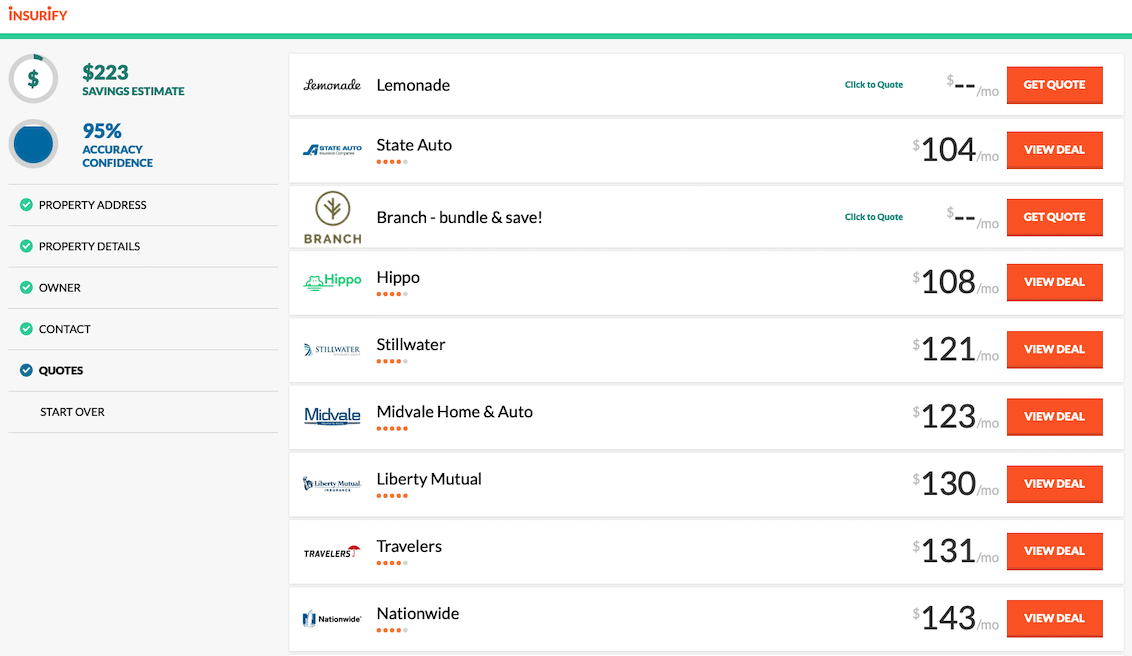

Allstate Insurance is a good choice if homeowners are in Florida. In addition to competitive rates, this insurance company offers above-average service. Allstate is one of the biggest insurers, so it's easy to access it from almost anywhere. To find the best deal, however, you need to compare Allstate’s insurance rates with at LEAST three or four other insurers.

This company is among the most popular among homeowners in Florida. Its history dates back to 1864, and it carries an A++ financial strength rating from AM Best. You can also save money by obtaining endorsements or discounts. These include hidden water damages coverage, loyalty discounts, multi-policy discounts, and discounts for smart home security. You can also tailor your insurance coverage by choosing the coverage and deductible levels that best suit your needs.

Travelers

Travelers offers standard home coverage, as well as additional coverage packages that offer better value. The company offers customer service that can help you customize your coverage to cover more assets. For example, you can add a green home upgrade to your policy to cover the costs of repairing or replacing green materials. You can expect average customer service from this company, regardless of the type of coverage that you select.

Travelers also offers personal item replacement cost settlement. This will pay you for your personal items at replacement price in the event that they are damaged or destroyed. This coverage covers the cost for replacement of personal property. There is no depreciation. The policy covers many items including medical expenses, property loss, and loss of use.

Chubb

Chubb homeowners insurance in Florida comes with a range of extra features. You might not be aware that Chubb offers additional coverage for sewer backups when you are looking into your home insurance. For discounts, these policies can be combined to other insurance products. Visit Chubb's site for more information.

If your home is damaged by fire, Chubb's insurance offers cash settlements for covered total losses. The company will offer temporary housing in hotels and similar properties nearby. Chubb will also pay for your food and lodging expenses. In addition, it covers damages caused by natural disasters, as well as liability lawsuits.

Universal Property

Universal Property Insurance offers homeowners a variety of discounts. Some of these discounts include automatic payment from your credit card or bank account, electronic statements, and claims-free discounts. Installing protective devices around the home can help you save money. Universal also provides replacement cost coverage for property that has been damaged.

Universal Property & Casualty Insurance Company was established in 1997. It offers home insurance in Florida as well as in many other states. The state's homeowner insurance market is 9.7 percent of the company's total. The company sells both home insurance directly to the consumer and through independent insurers.